As investors brace themselves, Dalal Street is poised for a turbulent week ahead. A confluence of elements including global economic uncertainty, domestic political developments, and important corporate earnings reports are likely to drive market sentiment.

- Market Experts

- are

- heightened volatility

- with or upside and downside possibilities.

Investors are encouraged to remain wary, monitor market movements closely, and hold onto a well-diversified portfolio.

Investors Focused: This Week's Crucial Earnings

This week, investors will be eagerly analyzing key earnings reports from a variety of companies across multiple sectors. Tech giants like Apple and Microsoft are set to report their quarterly figures, providing valuable insights into the state of the technology industry. Meanwhile, consumer staples companies like Procter & Gamble and Coca-Cola will offer a glimpse into consumer spending patterns in this economic climate. With uncertainty running high, these earnings reports are sure to generate buzz.

- Experts will be closely watching for any clues of supply chain disruptions that could affect future performance.

- Predictions on future earnings growth will also be crucial for investors, as it will determine their perception of the companies' long-term prospects.

Geopolitical Tensions Could Cast Shadow on Dalal Street

Global conflicts are increasing, and these trends could have a noticeable impact on India's stock market, the Dalal Street. Investor outlook remains vulnerable in the face of uncertainty, with geopolitical risks casting a veil over market prospects. Analysts are closely monitoring global events, as they could spark volatility in the Indian stock market.

It is crucial for investors to exercise prudence and consider their portfolios meticulously in this fluid environment.

Analysts Predict Varied Sentiments as Week Begins

Financial analysts/experts/commentators are forecasting/predicting/speculating a volatile/mixed/unpredictable week ahead for the market, with investors/traders/enthusiasts holding/watching/waiting closely to see how recent events impact/influence/affect sentiment. Economic/Global/Industry indicators released earlier this week have sparked/generated/fuelled debate/discussion/concern among participants/players/stakeholders, with some pointing/highlighting/emphasizing potential opportunities/challenges/risks. The coming Dalal Street Week Ahead days will be crucial/critical/decisive in shaping market direction, and analysts are keeping/maintaining/observing a keen/close/sharp eye on key developments.

Will FII Inflows Propel Dalal Street Higher?

The recent surge in Foreign Institutional Investor (FII) inflows has sparked optimism among market participants about the potential trajectory of the Indian stock market, commonly known as Dalal Street. Analysts believe that sustained FII investments could function as a major catalyst for continued growth.

A key factor motivating this positive sentiment is the strong economic outlook of India. Boosting this, the government's business-friendly policies have also enticed significant international investment.

However, it is important to note that market performance can be influenced by a multitude of factors, both domestic and global. Headwinds such as inflation, interest rate hikes, and geopolitical tensions could potentially temper the impact of FII inflows on Dalal Street's performance in the near months.

Ultimately, the extent to which FII inflows lift Dalal Street higher remains to be determined.

Technical Outlook: Can Bulls Hold Fort This Week?

As we head into a fresh week in the market, investors are eagerly awaiting developments that could determine the near-term direction of prices. Technical indicators suggest a choppy period ahead, with both bullish and bearish forces {battling{ for control. Momentum oscillators show signs of oscillation, while key support levels are being tested. A decisive break above resistance|below support could {ignite{ a trend reversal, but until then, the market is likely to remain range-bound.

Key events on the economic calendar this week include the release of consumer confidence numbers, which could {provide{ further clues about the health of the economy and influence central bank policy. Traders will also be watching for updates from major corporations, as earnings reports continue to roll in.

With the market struggling for direction, investors are encouraged to exercise caution and {manage risk{ carefully. Staying informed about developments that could impact the market is crucial during these volatile times.

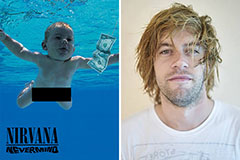

Spencer Elden Then & Now!

Spencer Elden Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Batista Then & Now!

Batista Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!